Investment Planning: Essential 5-Step Process To Build An Investment Portfolio Suitable For YOU

Whether you are doing DIY or engaging a Financial Adviser to build your investment portfolio, we would like to share with you the essential 5-step process to build an investment portfolio suitable for you.

Step 1: Understanding Your Risk Appetite

When thinking about investing, the first thing that comes to people’s mind is the return. It is natural to get drawn to the investment returns, but that is definitely not the first thing you want to think about. Instead, you need to think about your risk appetite.

Risk appetite, or risk tolerance, is the amount of risk you are willing to withstand in order for you to achieve your investment goal. Understanding your risk appetite is an important step in building your portfolio because it helps you define your boundaries. It guides you when making a decision on the type of investments to include in your portfolio.

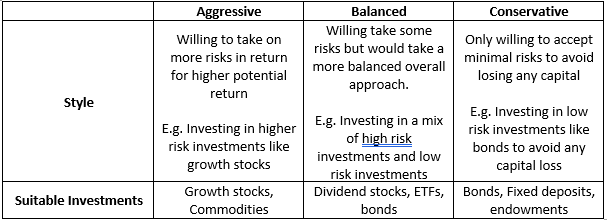

Risk appetite can be broken down into three categories: Aggressive, moderate and conservative.

The way to get an objective understanding of your own risk appetite is through a risk appetite test. By answering some behavioral questions on how you would react while investing, the test will be able to give you an accurate depiction of your personal risk appetite.

Step 2: What Is The Purpose Of Your Portfolio?

Once you are in the know about your own risk appetite, the next step is to consider the purpose of your portfolio and your expected return.

The purpose of your portfolio is the end goal you expect to achieve with your portfolio. It will determine how you allocate your assets, how much holding time you have for your investments and how much returns you can expect. These three aspects come hand in hand in a balanced manner.

There are many different purposes you can expect to achieve, from retiring in 30 years’ time to supporting your child’s tertiary education to making the down payment for your first home or even paying for your wedding banquet.

Let’s say you are looking to save for the deposit of your first home in five years’ time. (List down in point form as much to read) As such, your investment holding period is five years. Next, you need to determine how much you need by the end of five years to decide how much returns you need to achieve. Once the expected return is established, you can then decide your asset allocation with the aim of achieving the expected return. But, not to forget, you still need to tie it back with your risk appetite to ensure that you do not end up making sub-optimal investment decisions because of your inherent risk appetite.

Step 3: Designing And Building Your Portfolio

You are now clear about the direction of your portfolio and your psychological tolerance against losses. The next step is to design and build your portfolio while keeping your portfolio’s purpose and your personal risk tolerance in mind.

How Should You Allocate Your Capital?

To build your portfolio, you need to first decide how much capital to allocate into each type of asset class.

There are five major asset classes that you can invest your capital in: Stocks, bonds, property, commodities and cash. Each of these asset class has different purpose and behave differently in different environment. For example, stocks allow you to grow your wealth in a bull market while bonds protect your wealth in a bear market. They are negatively correlated and behave in opposite manner. Property and commodity act as hedging tools against inflation while cash helps your portfolio maintain liquidity.

Deciding how much capital to allocate into each type of asset class is a result of your portfolio’s purpose and your personal risk tolerance.

Choosing What To Invest In For Each Asset Class

Next, you need to do your own due diligence and research to decide what to invest in for each asset class.

For example, if you are planning to invest in bonds, you need to decide which bond to buy. Is it a government or a corporate bond? Is it going to be investment grade or high yield bond? How long should the bond duration be, e.g. 5 years or 10 years? If you are investing in stocks, the same decision needs to be made. Which company’s stock will you invest in? Is it going to be a value stock, dividend stock or growth stock? Which geographic region will you be investing in?

Passive Investing: Using Unit Trusts/ETF As A Base

So, instead of cracking your brains to decide which individual stock or bond to buy, why not get a whole basket of stocks through an ETF? One recommended way of building your portfolio is to use exchange traded funds (ETFs).

For more experienced investors, you can also use unit trusts to build the foundation of your portfolio with thematic funds, e.g. China-focused funds, tech-focused funds.

Seeking Alpha With Active Investing

As you gain more experience in investing, you can slowly start to try your hands-on stock picking to achieve higher return (aka alpha). Stock picking is an active investment strategy where you actively buy or sell stocks to exploit profitable situations. It requires you to do some research and analysis to find individual companies that promise alpha return. This will complement your base investments in ETF/unit trusts to try and achieve alpha return (i.e. return that beats the market performance).

Step 4: Monitoring Your Portfolio

With your portfolio designed, built and executed, you might be tempted to think that the job is done. Contrary to that belief, the job has just begun. With a portfolio that is in place, you need to keep watch on your portfolio to ensure that it is helping you achieve your purpose of investing and behaves the way you expect it to.

A recommended approach is to do a periodic assessment to monitor your portfolio. It can be a monthly, quarterly or half yearly review depending on your own comfort level. There are a few steps involved in reviewing your portfolio.

1. Review Your Portfolio’s Performance

Firstly, you need to assess your portfolio’s performance against your goal and the benchmark (e.g. STI) return. Ideally, it should hit your expected return and exceed the benchmark return.

If it misses both your expected return and the benchmark return, you need to review what went wrong and how to fix it. If it misses the benchmark return but achieves your expected return, you also need to find out why your portfolio underperformed the benchmark.

2. Review Your Asset Allocation

Secondly, you need to review your asset allocation. The value of your investments would have changed, which could result in an imbalance in asset allocation. If this happens you will need to do some rebalancing to ensure that your asset allocation is adjusted.

3. Review Your Portfolio’s Purpose

Lastly, which is also the most important step, you need to review your portfolio’s purpose. You must not forget the reason why you begun investing in the first place. As time passes, your purpose of investing might have changed along the way.

For example, if you are trying to make the down payment for your first home and have already made it, you need to set another goal for yourself. Once you have set a new direction for your portfolio, repeat step 3-5 to re-design your portfolio for the new purpose.

Step 5: Rebalance Periodically

Rebalancing is an essential step in maintenance of your investment portfolio. This step involves selling and buying new investments to reallocate your capital. There are two types of rebalancing: Regular rebalancing and strategic rebalancing.

Regular Rebalancing

Regular rebalancing, as the name suggests, is a type of rebalancing done on a periodic basis. The idea of regular rebalancing is to buy and sell investments to maintain the original desired level of asset allocation (determined in step 3).

For example, when the stock market is having a bull run, the value of stocks in your portfolio will inflate. This will cause the asset allocation in your portfolio to change, e.g. from 50% (original) to 65%. Since your risk appetite and the purpose of your portfolio determined that you should allocate only 50% to stocks, you need to take profit on your stocks. The profit can either be used to reinvest in bonds or kept as cash.

Strategic Rebalancing

The other type of rebalancing is strategic rebalancing. Unlike regular rebalancing, strategic rebalancing is done on an ad-hoc basis. Strategic rebalancing done whenever you when you have an expectation of the market.

For example, with the increasing valuation in the stock market, you might be expecting a correction to take place in the stock market. Thus, you might feel that this is not an opportune time to be allocating so much capital from your portfolio into stocks. You will then carry out a strategic rebalancing and adjust your asset allocation in stocks. Similarly, whenever you feel that there are opportunities in the market, you will carry out a strategic rebalancing to increase asset allocation in stocks.

There is another way you can do a strategic rebalancing, i.e. shifting your investments within a single asset class.

Taking The First Step Is The Most Important Step

While this simple five 5-step process is no sure-win formula, it is a good starting point for you to build your own portfolio of investments. Taking the first step to building your own portfolio of investment is the most crucial step. It is what is standing between you and a brighter financial future for yourself and your loved ones.

Mr. Alfred Chia

CEO of SingCapital

www.singcapital.com.sg

Feel free to drop an email to [email protected] for questions or to find out more on building an investment portfolio specifically for you.

Whether you are doing DIY or engaging a Financial Adviser to build your investment portfolio, we would like to share with you the essential 5-step process to build an investment portfolio suitable for you.

Step 1: Understanding Your Risk Appetite

When thinking about investing, the first thing that comes to people’s mind is the return. It is natural to get drawn to the investment returns, but that is definitely not the first thing you want to think about. Instead, you need to think about your risk appetite.

Risk appetite, or risk tolerance, is the amount of risk you are willing to withstand in order for you to achieve your investment goal. Understanding your risk appetite is an important step in building your portfolio because it helps you define your boundaries. It guides you when making a decision on the type of investments to include in your portfolio.

Risk appetite can be broken down into three categories: Aggressive, moderate and conservative.

The way to get an objective understanding of your own risk appetite is through a risk appetite test. By answering some behavioral questions on how you would react while investing, the test will be able to give you an accurate depiction of your personal risk appetite.

Step 2: What Is The Purpose Of Your Portfolio?

Once you are in the know about your own risk appetite, the next step is to consider the purpose of your portfolio and your expected return.

The purpose of your portfolio is the end goal you expect to achieve with your portfolio. It will determine how you allocate your assets, how much holding time you have for your investments and how much returns you can expect. These three aspects come hand in hand in a balanced manner.

There are many different purposes you can expect to achieve, from retiring in 30 years’ time to supporting your child’s tertiary education to making the down payment for your first home or even paying for your wedding banquet.

Let’s say you are looking to save for the deposit of your first home in five years’ time. (List down in point form as much to read) As such, your investment holding period is five years. Next, you need to determine how much you need by the end of five years to decide how much returns you need to achieve. Once the expected return is established, you can then decide your asset allocation with the aim of achieving the expected return. But, not to forget, you still need to tie it back with your risk appetite to ensure that you do not end up making sub-optimal investment decisions because of your inherent risk appetite.

Step 3: Designing And Building Your Portfolio

You are now clear about the direction of your portfolio and your psychological tolerance against losses. The next step is to design and build your portfolio while keeping your portfolio’s purpose and your personal risk tolerance in mind.

How Should You Allocate Your Capital?

To build your portfolio, you need to first decide how much capital to allocate into each type of asset class.

There are five major asset classes that you can invest your capital in: Stocks, bonds, property, commodities and cash. Each of these asset class has different purpose and behave differently in different environment. For example, stocks allow you to grow your wealth in a bull market while bonds protect your wealth in a bear market. They are negatively correlated and behave in opposite manner. Property and commodity act as hedging tools against inflation while cash helps your portfolio maintain liquidity.

Deciding how much capital to allocate into each type of asset class is a result of your portfolio’s purpose and your personal risk tolerance.

Choosing What To Invest In For Each Asset Class

Next, you need to do your own due diligence and research to decide what to invest in for each asset class.

For example, if you are planning to invest in bonds, you need to decide which bond to buy. Is it a government or a corporate bond? Is it going to be investment grade or high yield bond? How long should the bond duration be, e.g. 5 years or 10 years? If you are investing in stocks, the same decision needs to be made. Which company’s stock will you invest in? Is it going to be a value stock, dividend stock or growth stock? Which geographic region will you be investing in?

Passive Investing: Using Unit Trusts/ETF As A Base

So, instead of cracking your brains to decide which individual stock or bond to buy, why not get a whole basket of stocks through an ETF? One recommended way of building your portfolio is to use exchange traded funds (ETFs).

For more experienced investors, you can also use unit trusts to build the foundation of your portfolio with thematic funds, e.g. China-focused funds, tech-focused funds.

Seeking Alpha With Active Investing

As you gain more experience in investing, you can slowly start to try your hands-on stock picking to achieve higher return (aka alpha). Stock picking is an active investment strategy where you actively buy or sell stocks to exploit profitable situations. It requires you to do some research and analysis to find individual companies that promise alpha return. This will complement your base investments in ETF/unit trusts to try and achieve alpha return (i.e. return that beats the market performance).

Step 4: Monitoring Your Portfolio

With your portfolio designed, built and executed, you might be tempted to think that the job is done. Contrary to that belief, the job has just begun. With a portfolio that is in place, you need to keep watch on your portfolio to ensure that it is helping you achieve your purpose of investing and behaves the way you expect it to.

A recommended approach is to do a periodic assessment to monitor your portfolio. It can be a monthly, quarterly or half yearly review depending on your own comfort level. There are a few steps involved in reviewing your portfolio.

1. Review Your Portfolio’s Performance

Firstly, you need to assess your portfolio’s performance against your goal and the benchmark (e.g. STI) return. Ideally, it should hit your expected return and exceed the benchmark return.

If it misses both your expected return and the benchmark return, you need to review what went wrong and how to fix it. If it misses the benchmark return but achieves your expected return, you also need to find out why your portfolio underperformed the benchmark.

2. Review Your Asset Allocation

Secondly, you need to review your asset allocation. The value of your investments would have changed, which could result in an imbalance in asset allocation. If this happens you will need to do some rebalancing to ensure that your asset allocation is adjusted.

3. Review Your Portfolio’s Purpose

Lastly, which is also the most important step, you need to review your portfolio’s purpose. You must not forget the reason why you begun investing in the first place. As time passes, your purpose of investing might have changed along the way.

For example, if you are trying to make the down payment for your first home and have already made it, you need to set another goal for yourself. Once you have set a new direction for your portfolio, repeat step 3-5 to re-design your portfolio for the new purpose.

Step 5: Rebalance Periodically

Rebalancing is an essential step in maintenance of your investment portfolio. This step involves selling and buying new investments to reallocate your capital. There are two types of rebalancing: Regular rebalancing and strategic rebalancing.

Regular Rebalancing

Regular rebalancing, as the name suggests, is a type of rebalancing done on a periodic basis. The idea of regular rebalancing is to buy and sell investments to maintain the original desired level of asset allocation (determined in step 3).

For example, when the stock market is having a bull run, the value of stocks in your portfolio will inflate. This will cause the asset allocation in your portfolio to change, e.g. from 50% (original) to 65%. Since your risk appetite and the purpose of your portfolio determined that you should allocate only 50% to stocks, you need to take profit on your stocks. The profit can either be used to reinvest in bonds or kept as cash.

Strategic Rebalancing

The other type of rebalancing is strategic rebalancing. Unlike regular rebalancing, strategic rebalancing is done on an ad-hoc basis. Strategic rebalancing done whenever you when you have an expectation of the market.

For example, with the increasing valuation in the stock market, you might be expecting a correction to take place in the stock market. Thus, you might feel that this is not an opportune time to be allocating so much capital from your portfolio into stocks. You will then carry out a strategic rebalancing and adjust your asset allocation in stocks. Similarly, whenever you feel that there are opportunities in the market, you will carry out a strategic rebalancing to increase asset allocation in stocks.

There is another way you can do a strategic rebalancing, i.e. shifting your investments within a single asset class.

Taking The First Step Is The Most Important Step

While this simple five 5-step process is no sure-win formula, it is a good starting point for you to build your own portfolio of investments. Taking the first step to building your own portfolio of investment is the most crucial step. It is what is standing between you and a brighter financial future for yourself and your loved ones.

Mr. Alfred Chia

CEO of SingCapital

www.singcapital.com.sg

Feel free to drop an email to [email protected] for questions or to find out more on building an investment portfolio specifically for you.