Should You Be Investing The Money In Your CPF?

It is common knowledge to invest to grow our wealth. But does everyone know why you should be investing? Investing can be for a variety of reasons from building your family’s child-raising fund for your first child to securing an education fund for your child’s tertiary education to growing your own retirement fund.Among these reasons, growing your own retirement fund is a very important long-term goal. After all, the large sum of retirement savings and time required to achieve the retirement savings means that you have to start saving early. You will have to save a lot more when you start late.

The Math To Planning For Retirement

How Much Do You Need To Retire Without Worries For 20 Years At Your Desired Retirement Age?

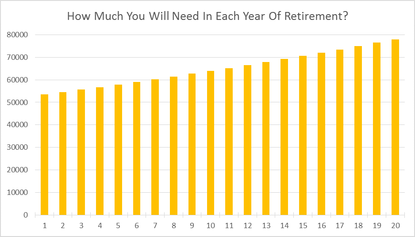

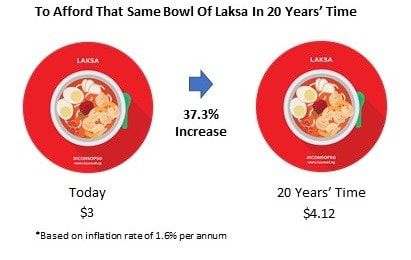

Let’s say you are now 45 years old. You are looking to retire in 20 years’ time with a monthly retirement income of $3,000 until you are age 85. If the average inflation rate is around 2%, this means that you will need $4,454 per month in 20 years’ time to afford the same standard of living as $3,000 in today’s context.

By doing some math, you will realize that you need retirement savings of around $1.3 Million at age 65 for the desired retirement lifestyle.

The Math To Planning For Retirement

How Much Do You Need To Retire Without Worries For 20 Years At Your Desired Retirement Age?

Let’s say you are now 45 years old. You are looking to retire in 20 years’ time with a monthly retirement income of $3,000 until you are age 85. If the average inflation rate is around 2%, this means that you will need $4,454 per month in 20 years’ time to afford the same standard of living as $3,000 in today’s context.

By doing some math, you will realize that you need retirement savings of around $1.3 Million at age 65 for the desired retirement lifestyle.

Chart: How much you will need in each year of your retirement due to the impact of inflation, based on a lifestyle of $3,000 per month (as of today). Note: Year 1 = age 65 (in 20 years’ time).

How Much Do You Need To Save Every Month To Achieve Your Retirement Savings Goal?

If you start saving from now (age 45), how much will you need to save every month to hit the $1M retirement savings target by age 65? Well, it depends.

How Much Do You Need To Save Every Month To Achieve Your Retirement Savings Goal?

If you start saving from now (age 45), how much will you need to save every month to hit the $1M retirement savings target by age 65? Well, it depends.

If you are relying on CPF OA’s 2.5% guaranteed return, you will need to save ~$3,200 every month for the next 20 years. But if you are able to generate better rate of return (e.g. 8%), you only need to save $1,750 every month. That’s almost one-third of the amount that you would need to save if you just relied on CPF OA’s 2.5% guaranteed interest rate. This is why CPF member who has higher risk profile take on investment risk to achieve better returns so that they can reach their goals faster. However, do note that all investments carry risks. You need to do your homework or engage a Financial Consultant before investing.

How Can You Speed Up Your Retirement Savings Goal Or At Least Make It Easier?

This section is catered to those who want to speed up your retirement savings goal:

1.Eighth Wonder Of The World: Compound Interest

A small compound interest coupled with a long enough time period can do wonders. Quoting a genius like Albert Einstein: “He who understands (compound interest), earns it. And he who doesn’t, pays it”.

With a compound interest of 2.5% and 20 years’ time, your savings of $10,000 can grow to 160% its original amount, i.e. $16,386.16. If you know how to leverage on the concept of compound interest, you can reach your retirement goal faster.

Does 2.5% sound familiar to you? It should, because it is the guaranteed interest rate that CPF pays on your CPF OA. Your CPF is helping you to earn compound interest on your CPF money every year! While you are working hard to chalk up more savings, your money is also working hard by growing on its own.

2.Want More Compounding? Increase The Rate Of Return Of Your CPF Savings

CPF OA’s guaranteed rate of return of 2.5% is a good deal, especially if you compare across the region or even the world. But what if you want to grow your CPF savings at a faster rate?

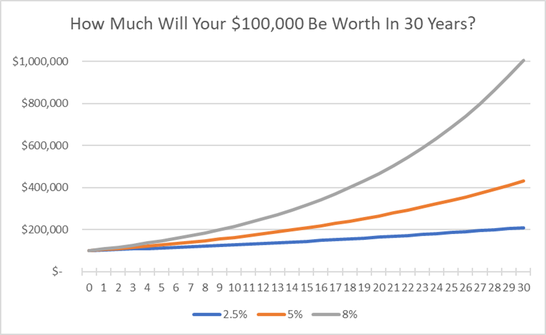

Chart: How much your $100,000 will be worth in 30 years based on different compounding rate (2.5%, 5% and 8%)

Time and rate of return are the two factors in the concept of compound interest that will determine how fast your savings grow. If you want to grow your CPF savings at a faster rate, you can either increase the time period that your CPF savings get compounded or you can think of ways to increase the rate of return. Since time is something you can’t unwind, the only way is to increase the rate of return. This explains why investors are willing to take on investment risk to achieve potential higher returns.

This section is catered to those who want to speed up your retirement savings goal:

1.Eighth Wonder Of The World: Compound Interest

A small compound interest coupled with a long enough time period can do wonders. Quoting a genius like Albert Einstein: “He who understands (compound interest), earns it. And he who doesn’t, pays it”.

With a compound interest of 2.5% and 20 years’ time, your savings of $10,000 can grow to 160% its original amount, i.e. $16,386.16. If you know how to leverage on the concept of compound interest, you can reach your retirement goal faster.

Does 2.5% sound familiar to you? It should, because it is the guaranteed interest rate that CPF pays on your CPF OA. Your CPF is helping you to earn compound interest on your CPF money every year! While you are working hard to chalk up more savings, your money is also working hard by growing on its own.

2.Want More Compounding? Increase The Rate Of Return Of Your CPF Savings

CPF OA’s guaranteed rate of return of 2.5% is a good deal, especially if you compare across the region or even the world. But what if you want to grow your CPF savings at a faster rate?

Chart: How much your $100,000 will be worth in 30 years based on different compounding rate (2.5%, 5% and 8%)

Time and rate of return are the two factors in the concept of compound interest that will determine how fast your savings grow. If you want to grow your CPF savings at a faster rate, you can either increase the time period that your CPF savings get compounded or you can think of ways to increase the rate of return. Since time is something you can’t unwind, the only way is to increase the rate of return. This explains why investors are willing to take on investment risk to achieve potential higher returns.

3. It’s Time To Start Thinking About Investing Your CPF Money

One way you can increase the rate of return is by investing the money in your CPF. To allow CPF members to grow your CPF savings, you are allowed to invest your CPF money through the CPF Investment Scheme (CPFIS). CPFIS allows you to invest in a range of financial products from bonds, unit trusts, ETF, investment-linked policies (ILPs) to property funds.

While CPF OA provide risk-free returns of 2.5%, you will have to move out of the comfort zone if you want to be able generate better returns to make your CPF OA savings work harder.

How Should You Get Started With Investing Your CPF Money?

However, investing isn’t as easy as finding a single financial product and committing all your CPF money into it. You need to adopt a balanced approach that gives you potential upside from investments while still protecting your downside when the market is underperforming. Furthermore, every investment comes with its own risk. Thus, you need to understand the risks involved in investing for different types of investment products.

One thing you can do is to engage professional advice from financial advisors to help you design a portfolio that is suited for your financial goals. Sign up for a complimentary consulting session with our financial advisors to find out how you can leverage on CPFIS to grow your retirement savings to achieve your financial goals.

One way you can increase the rate of return is by investing the money in your CPF. To allow CPF members to grow your CPF savings, you are allowed to invest your CPF money through the CPF Investment Scheme (CPFIS). CPFIS allows you to invest in a range of financial products from bonds, unit trusts, ETF, investment-linked policies (ILPs) to property funds.

While CPF OA provide risk-free returns of 2.5%, you will have to move out of the comfort zone if you want to be able generate better returns to make your CPF OA savings work harder.

How Should You Get Started With Investing Your CPF Money?

However, investing isn’t as easy as finding a single financial product and committing all your CPF money into it. You need to adopt a balanced approach that gives you potential upside from investments while still protecting your downside when the market is underperforming. Furthermore, every investment comes with its own risk. Thus, you need to understand the risks involved in investing for different types of investment products.

One thing you can do is to engage professional advice from financial advisors to help you design a portfolio that is suited for your financial goals. Sign up for a complimentary consulting session with our financial advisors to find out how you can leverage on CPFIS to grow your retirement savings to achieve your financial goals.